By Charles Kenny, Vijaya Ramachandran, and Guido Núñez-Mujica

This post was originally published by the Center for Global Development, and is based on a report published by Breakthrough and Center for Global Development in 2023.

What counts as climate finance? Analysis of 2554 projects financed by the World Bank between 2000 and 2022 showed not just a bias to mitigation but also a very wide range of activities, some of which looked at best tenuously related to climate, including teacher training in Guyana and civil service payment automation in Afghanistan.

In the last couple of years, patterns of behavior don’t appear to have changed that much. We replicated the scraping technique of the earlier paper to look at World Bank climate projects in FY23 and FY24. Of 925 projects that reported thematic areas, 825 were tagged as climate change-related. 751 projects were tagged as related to climate adaptation and 695 to mitigation.

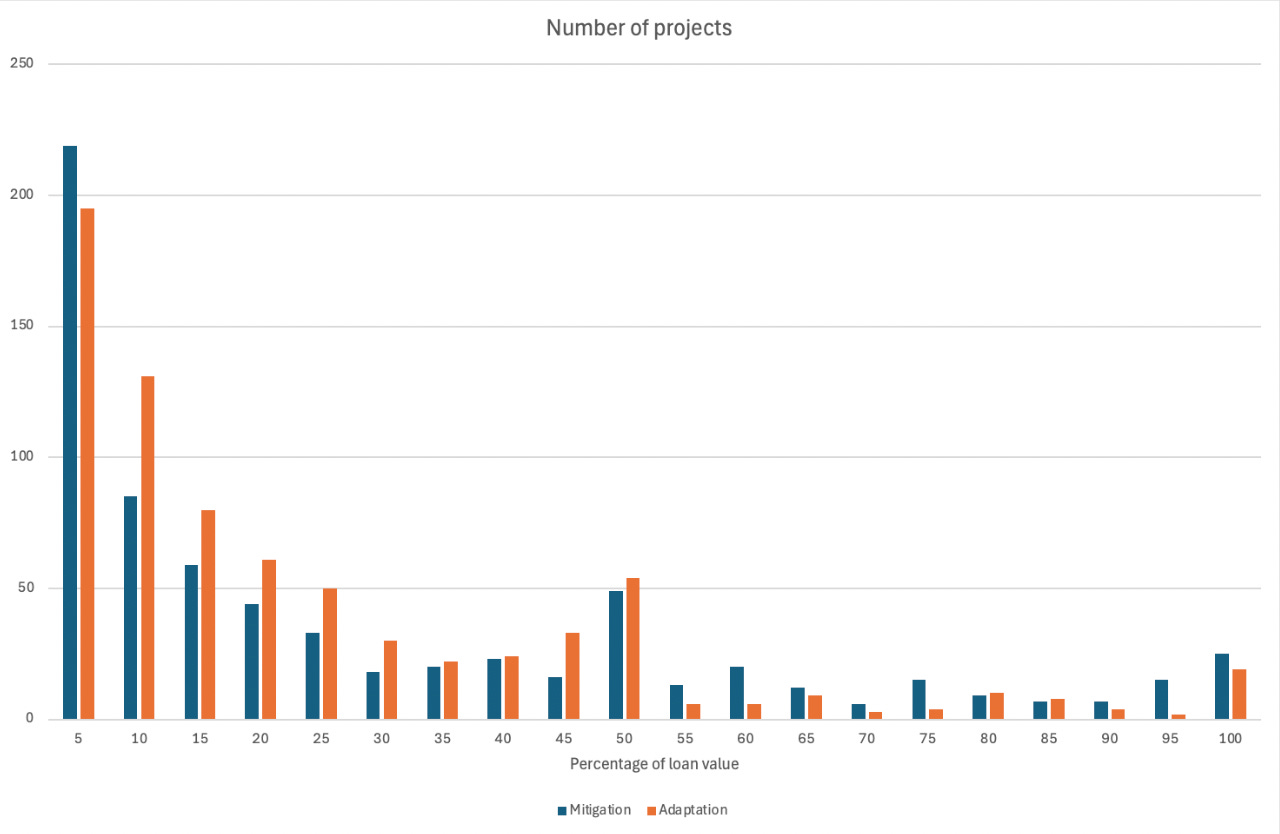

Country-specific climate change spending, calculated by multiplying the share of the project allocated to climate and the value of the loan, totaled $55 billion, out of a project total of $153 billion for FY23 and FY24—about one third of total spending. Of this, 64 percent was directed towards mitigation and 36 percent towards adaptation. The figure below shows that for every income group, mitigation spending exceeds that on adaptation. It is somewhat of a mystery why the World Bank claims to have spent over $3 billion in two years on mitigation in the poorest countries that account for less than one percent of global emissions.

Figure 1: Adaptation vs. mitigation spending by income classification

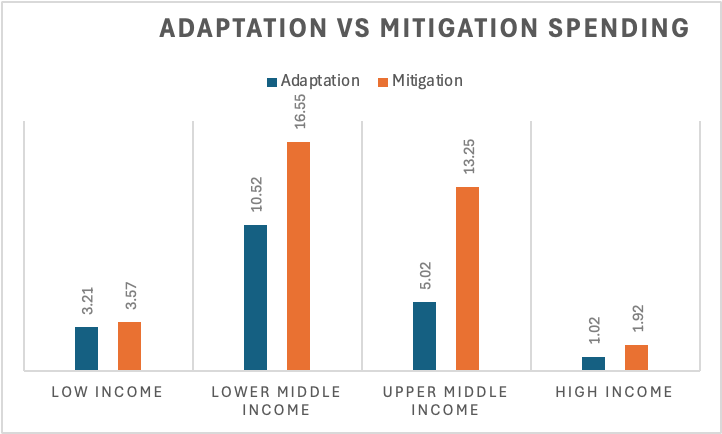

And for climate, it still appears that almost everything counts in small amounts: the pattern of labeling a little bit of a lot of projects as climate-focused continues. Figure 2 shows that 630 climate projects were tagged with less than 10 percent of loan value being related to climate. The problems with unreliability and inadequate documentation also persist. The Bank has launched a new version of the protocols for data exchange on its climate finance data (the API) that has dropped multiple data fields supported by the previous version. Ad hoc changes to the labeling of projects, without any warning to the user, have made the database difficult to use (as we observed when we ran the same analysis twice over the course of a month and got different results).

Figure 2: Number of projects labeled mitigation or adaptation

To be fair, and to repeat, it is utterly justifiable to have a broad sectoral definition of adaptation: economic development is a powerful adaptation strategy. But adaptation finance should be focused on the countries who need it (and deserve it) most: the poorest countries who have contributed the least to climate change but are some of the most exposed to its risks. Meanwhile it is a legitimate question as to how much the Bank should be financing activities that are only justifiable on grounds of their climate mitigation impact: clients have made clear they don’t think the institution should be focused on that. And in all of this it remains very hard to say how much, if any, of what is being labeled climate finance by the World Bank is “activities that wouldn’t happen absent a climate focus.”

Given all of that, World Bank financing justified on the grounds of climate change should be clearly new and additional (remember that phrase?), as part of a climate dedicated capital increase. That would help transparently meet new climate financing commitments while preserving existing finance for client priorities. Any resulting adaptation finance should be directed toward the poorest countries which deserve it most, and the mitigation finance linked to projects that have low-, no-, or negative-emission approaches as a primary focus.

Of course, two years after the initial study, the World Bank (and the world) is in a different place. Look at the average number of mentions of the word “climate” in World Bank President Ajay Banga’s officialspeeches: 3.33 per speech in 2024, 0.33 so far in 2025. That rhetorical shift points to the fact that chances for a climate-dedicated capital increase are extremely slim given the current policy stance of the World Bank’s largest shareholder. But a transparent, additional approach for climate finance should still be the long-term end-goal for the World Bank as much as it should be globally.