Sub-Saharan Africa Needs Fossil Fuels to Process Its Critical Minerals

Three Case Studies of Localizing Value-Addition in Mineral Supply Chains

By Ryan Alimento and Seaver Wang

Collectively, the countries of sub-Saharan Africa (SSA) hold an estimated 30% of the world’s critical minerals by tonnage. African leaders have long hoped to translate resource endowments into economic development by refining mineral assets into higher-value chemicals and metals upon which semiconductors, communications equipment, clean energy, and other modern technologies rely. Instead of high-value products, however, resource-rich countries in SSA still often ship minimally processed mineral intermediates overseas, failing to realize much of the economic value of their geologic assets.

Conventional explanations as to why these countries have not been able to fully capitalize on their mineral holdings emphasize the same factors: financial uncertainty from political and social risks, limited access to regional markets, and inadequate buildout of clean energy. Attention towards these considerations seeks to advance common best practices for the nations of SSA and foster a more attractive environment for downstream industries relative to the business climates of wealthier, better-resourced countries.

But, development roadmaps entrenched in propositions of innovative financial vehicles, regional trade policy, and commodity market analyses overlook the fundamental need for fossil fuels to produce both the required thermal energy and industrial chemicals for value-additive mineral processing.

Competing with the United States or China in value-added processing is no simple task; hence, developmental economists and strategists wisely articulate solutions around sub-Saharan Africa’s resource strengths (e.g., abundant renewable electricity and mineral resources) to leverage the region’s comparative advantages. Many such strategies also focus heavily on improving SSA’s overall financing environment, emphasizing the need for greater mineral sector prioritization from multilateral national banks. Other common points include driving more integrated and regional growth via collaboration between SSA countries and continued efforts to expand electricity infrastructure as well as developing a trained local workforce by expanding technical collaboration with advanced economies. These suggestions are often accompanied by a mountain of analytical evidence, intending to communicate the enormity of the market opportunity available to Africa by processing its minerals to serve the clean energy economy.

These are vitally important priorities at a high level, but they often do not engage sufficiently with the granular engineering challenges of nurturing domestic chemical and metallurgical industries.

To illustrate the technical necessity of fossil fuels and industrial chemicals in real-world mineral processing, we explore the mineral industries of the Democratic Republic of the Congo (DRC), Guinea, and Mozambique with a quantitative, engineering-driven analysis. Each nation’s value-adding aspirations face unique hurdles linked to their different mineral resources and varying stages of development. But across the board, the need for increased petrochemical investment rings clear.

Cobalt and Copper in the Democratic Republic of the Congo

The DRC is the world’s top producer of mined cobalt and the second-largest producer of both mined and refined copper. This corresponds to 220 ktpy (thousand tons per year) of mined cobalt (75% of global supply), 3,300 ktpy of mined copper (15% of global supply), and 2,500 ktpy of copper metal (9% of global supply). Despite its mineral wealth, the DRC is one of the poorest countries in the world; the World Bank estimates that the DRC is home to one in six people in sub-Saharan Africa living in extreme poverty. A recent large-scale offensive by the M23 armed militant group, allegedly aided by the neighboring Rwandan government, disrupted a large fraction of the DRC’s copper and cobalt mining. In many cases, mining has not yet resumed.

The DRC currently exports cobalt in minimally processed forms, such as cobalt ore concentrate and cobalt hydroxide, but exports copper as metal that sits at the end of the copper value chain. For cobalt, a value-adding strategy would target production of battery-grade cobalt sulfate; however, no additional mineralogical processing can increase the value of the refined copper metal that the DRC already exports.

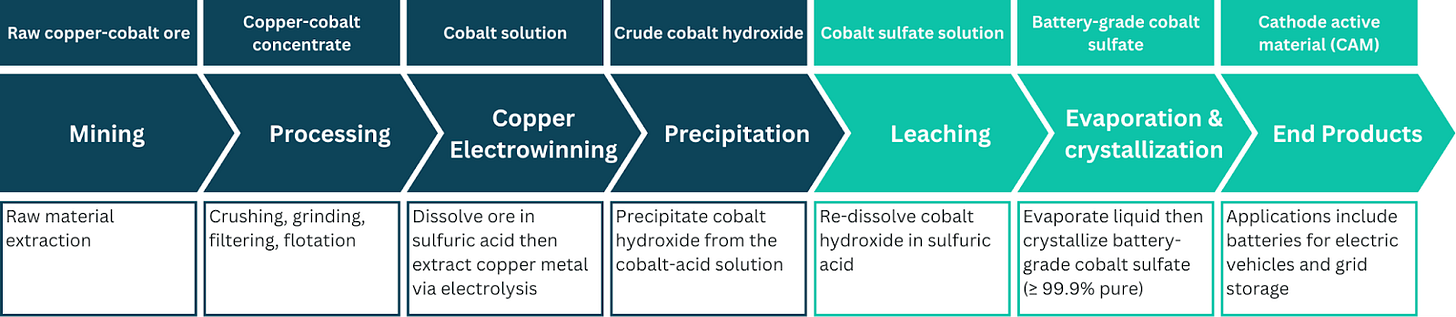

Figure 1 depicts the additional processing stages needed to produce battery-grade cobalt sulfate from the DRC’s cobalt hydroxide: leaching followed by evaporation and crystallization.

Figure 1: Major supply chain processing stages for copper-cobalt ores found in the DRC. Current practices in the DRC are shown in navy blue; subsequent value-adding processes are shown in light blue-green.

The evaporation and crystallization stages of cobalt sulfate production require demanding heat inputs (see Figure 2) that far exceed the DRC’s current utilization of thermal energy for industry. Heat constitutes only 0.2% (1.4 MW-thermal) of the total energy used by DRC industries—not enough to fuel a standard cobalt sulfate facility for even half a year.

Figure 2: Energy inputs (electric and non-electric) required to produce one metric ton of cobalt or copper material from the previous stage in the supply chain. Supply chain stages were selected for their specific relevance to the DRC’s cobalt and copper industries and for the DRC’s sulfide/oxide ore deposits.

There is no practical way to generate sufficient heat for cobalt sulfate synthesis without fossil fuels. Yet, the DRC neither imports nor uses any natural gas or coal, and offshore oil rigs extract a modest 25,000 barrels per day of petroleum for export instead of domestic use. Of the petrofuels that the DRC does consume, 98% are used in the transportation sector.

Altogether, the DRC’s inability to supply thermal energy to industry appears to be among the most restrictive hurdles facing its critical mineral value addition goals. To this end, the DRC must develop fossil fuel infrastructure—like pipelines and port terminals—to reliably supply industrial heat and train a workforce in the engineering and operational control needed for downstream cobalt processing. Yet, in an export-driven economy powered by hydroelectricity, there is little existing demand to justify domestic investment in fossil fuel infrastructure.

Development finance institutions are equipped with access to capital and statutory aims that are well-suited to tackle this dilemma. But, first, many would need to reevaluate their current stances against fossil fuel investments. A natural gas import terminal co-located with a cobalt sulfate plant could be an effective pilot investment in the DRC. Nearby gas power plants could also ensure that the cobalt sulfate plant and potential future port developments have stable electricity access. Regardless of the specific provisions, withholding fossil fuel investments in the DRC places upper limits on economic development that no regional trade agreement or creative financing method can remedy as effectively.

Aluminum and Alumina in Guinea

Guinea’s deposits of bauxite—the geologic source of aluminum—are the largest in the world. Guinea also mines the most bauxite in the world—around 130,000 ktpy or almost 30% of global supply. Despite its fruitful bauxite mining enterprise, Guinea exports 99.75% of its bauxite for processing abroad, over 80% of which is purchased by China.

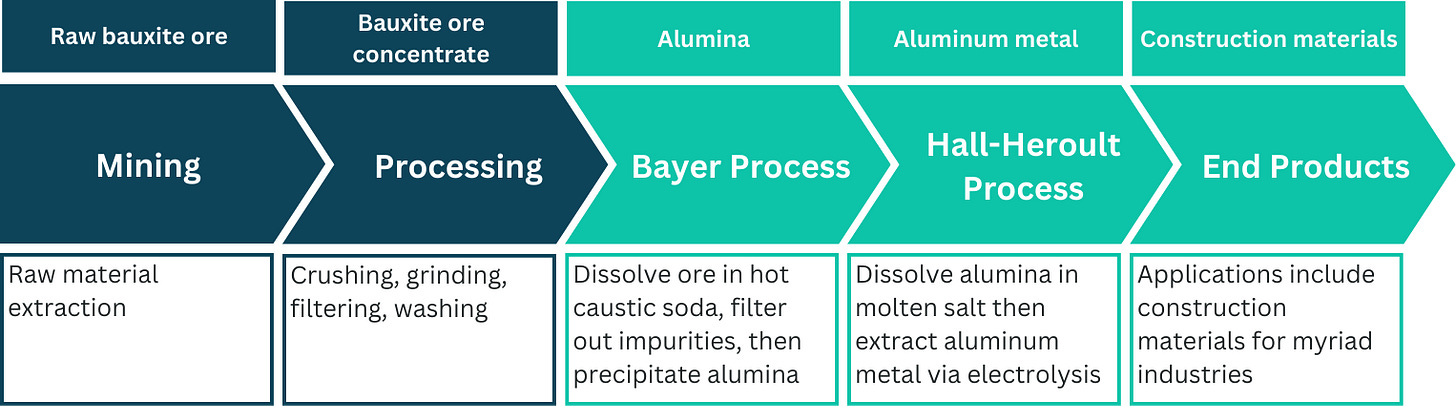

Bauxite is processed by refining it into alumina (aluminum oxide) via the Bayer process (Figure 3). Guinea is home to only one alumina refinery, the Friguia complex. Friguia has a recent history of inconsistent operation, but Guinea plans to open another far larger refinery in 2027 with backing from a Chinese firm.

Alumina is smelted into aluminum metal by electrolyzing alumina in a bath of molten cryolite salt. The required temperatures of over 1000℃ are achieved exclusively using electricity.

Figure 3: Major supply chain processing stages for bauxite ores found in Guinea. Current practices in Guinea are shown in navy blue; subsequent value-adding processes are shown in light blue-green.

As a whole, the aluminum supply chain is notoriously energy-intensive. Compared to Guinea's current bauxite mining practices, processing bauxite into alumina demands orders of magnitude more energy, and aluminum smelting requires even more (Figure 4).

Comparatively high thermal energy requirements for alumina refining indicates that refining may exceed Guinea’s capabilities. However, Guinea’s planned alumina refinery (with a capacity of 1,200 ktpy) would use 650 MWh-thermal/yr, about 10% of the country’s current industrial heat energy consumption. In the context of Guinea’s nascent industrial sector, this is a relatively reasonable value for an medium-sized alumina refinery. Thermal energy access, therefore, doesn’t appear to pose an immediate barrier to building another alumina refinery in Guinea. But more ambitious buildout beyond a single refinery would require substantially increasing industrial fossil fuel access.

In contrast, Guinea’s electrical generation capacity falls far short of supporting even a single aluminum smelter. After completion of the planned alumina refinery and assuming it has 50% average utilization, Guinea would produce around 875 ktpy of alumina. A theorized smelter handling half of this would consume 3.5 TWh-electric/yr—20% more electricity than all of Guinea generated in 2023, and 10x the electricity used by the industrial sector.

Beyond feasibility challenges, aluminum’s electricity demands would raise separate financial and environmental hurdles. Electricity makes up about 40% of smelters’ operating costs, and generating electricity for smelting released 600 Mt CO2-e in 2023, roughly 4% of global CO2 emissions from the power sector for that year. Major aluminum-producing nations like Russia, Canada, Norway, Iceland, and Brazil meet the high electricity demands for smelting, reduce electricity costs, and lower the carbon footprint of their aluminum by pairing smelters with hydropower. In the long-term, Guinea could adopt a similar strategy by leveraging its own substantial hydropower potential.

Even with such an arrangement, fossil fuels are still needed for a globally competitive aluminum smelter. Coal and petroleum are irreplaceable chemical precursors to the carbon anodes used by today’s smelters. Most smelters produce these fossil-derived anodes on-site, as importing them would balloon procurement costs that already make up 12-20% of smelters’ operating costs.

Guinea could also take advantage of the gallium content in their mined bauxite, as most of the world’s gallium is obtained as a byproduct during alumina refining. This has especially salient implications for Guinea’s bauxite industry, as raw material exports mean the industry loses out on the value of producing gallium, alumina, and aluminum. Very little gallium is made each year because it is found in extremely low concentrations (about 50 parts per million or 0.005%) and is exceedingly difficult to extract. However, even conservative estimates suggest that the bauxite Guinea mined in 2024 contained about 2,000 tons of recoverable gallium—over 2.5x as much as was produced globally that year (760 tons). Due to gallium’s strategic value, industry closely guards the process details needed to estimate the feasibility of gallium production in Guinea. From what little information can be inferred, gallium extraction would require the use of highly specialized resins in bauxite processing facilities much larger than the Friguia complex. It could prove fruitful for Guinea to leverage the strategic role of its gallium when pursuing alumina refinery investments, especially since China produces 99% of the world’s gallium and has recently banned gallium exports to the United States.

Gallium or not, a productive and vertically-integrated aluminum supply chain in Guinea’s future is possible but is contingent on increased fossil fuel access. Future expansions to alumina refining need fossil fuels to supply process heat, and an aluminum smelter uses fossil fuels as chemical feedstocks for carbon anodes. Moreover, the enormous electricity demands of aluminum smelting requires considerable expansions to Guinea’s generation of reliable electricity. A smelter’s electricity could be supplied using local hydropower, but a realistic plan to grow Guinean industry around clean electricity starts with using a non-negligible amount of petrochemicals.

Graphite in Mozambique

Mozambique was the second largest producer of natural graphite in 2023, yet it hosts only one active mine: the Balama mine, owned by Australian company Syrah Resources. The Balama mine broke ground in 2017 and processes graphite ore on-site to produce flake graphite concentrate. Syrah exports this intermediate product to its Vidalia facility in Louisiana which produces anode active material (AAM) for nearby U.S. battery manufacturers.

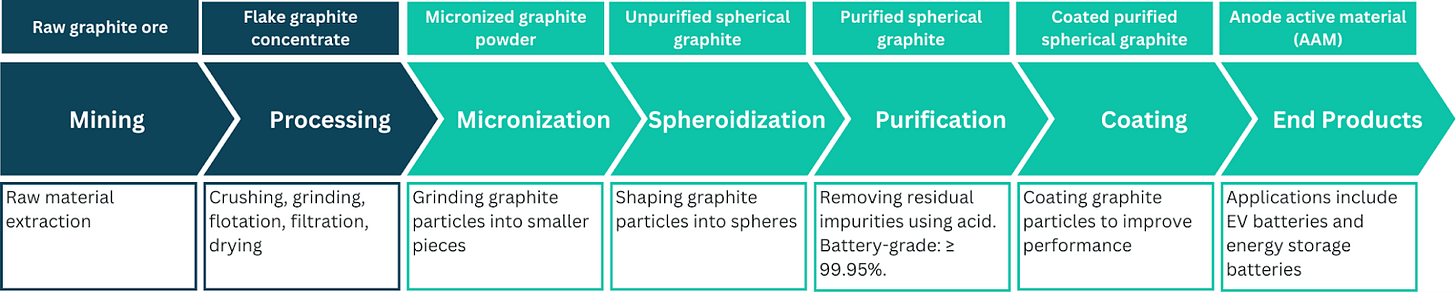

Figure 5: Major supply chain processing stages for graphite ores found in Mozambique. Current practices in Mozambique are shown in navy blue; subsequent value-adding processes are shown in light blue-green.

Unlike the chemical treatments for cobalt, copper, and aluminum, most value added to graphite is derived from the physical resizing or reshaping of graphite particles. The processing steps immediately following the Balama mine’s current operations are micronization and spheroidization which, respectively, entail grinding graphite particles into smaller sizes then pressing the particles into spheres. Though electricity use increases in these downstream steps, the total energy intensity is quite low compared to other minerals (Figure 6).

Figure 6: Energy inputs (electric and non-electric) required to produce one metric ton of graphite material from the previous stage in the supply chain. Supply chain stages were selected for their specific relevance to Mozambique’s graphite industry. For context, recall that cobalt sulfate production and alumina production require several MWh of electricity and/or thermal inputs per ton of output.

Producing unpurified spherical graphite from Mozambique’s graphite ore concentrate would require 19 GWh-electric/yr, less than 0.2% of Mozambique’s current industrial electricity consumption. Further, existing graphite ore concentrate processing requires more thermal energy per ton than spheroidization would. Unlike the DRC and Guinea, Mozambique’s potential to move up the graphite value chain is not limited by energy access .

Instead, non-energy factors have played an outsized role in deterring downstream graphite facilities. Most prominently, conflict with armed militant groups in the vicinity of the Balama mine in late 2024 forced Syrah to fully halt mining operations. A tentative restart is expected soon—but only after 6 months without production and with continued operational uncertainty moving forward.

Supply arrangements with customers also play an outsized role in determining where graphite value addition takes place. Syrah’s U.S.-based facility, for instance, contracted to supply battery-grade graphite to Tesla’s U.S.-based electric vehicle factories. This proximity to customers minimizes lead times, lowers transport costs, and reduces variability in supply—advantages that outweigh the benefits of processing near the mine itself.

To Compete, Sub-Saharan African Countries Need Abundant Energy

Most mines follow a similar procedure, regardless of the target mineral—excavating, crushing, then concentrating ores. As one moves further downstream in the mineral value chain, processing techniques increase in variety and complexity. Additional refining often demands applying orders of magnitude more electricity, process heat, and chemicals. Solutions to developmental barriers to downstream processing capacity in sub-Saharan Africa must move past blanket moratoriums on fossil fuel infrastructure to meet the heterogeneous needs of African economies.

Cobalt value addition in the DRC calls for enormous growth to domestic petrofuel supply chains, while Guinea needs to increase industrial access to both electrical and thermal energy if it hopes to refine more alumina and begin to smelt aluminum metal. Meanwhile, Mozambique’s graphite industry is exceptional in terms of the relative availability of both thermal and electrical energy, making the chief limitations to graphite value addition economic and political in nature rather than energy-related.

Certainly, Guinea and the DRC also face non-technical challenges like those in Mozambique. In all three countries, social and political instability discourages private investors, and there may not exist sufficient local labor with the proper experience to construct and operate chemical or metallurgical facilities. The comparative value proposition of developing projects in already-mature industrial environments partly explains why downstream processing continues to get sited abroad.

China’s market dominance—which spans the entirety of the downstream minerals supply chain—has created close business and logistical linkages between Chinese processing facilities and end-use battery and car manufacturers, further limiting competition from countries like DRC, Guinea, and Mozambique. To provide perspective on the sheer scale of integration between Chinese firms, China is the world’s largest producer of every value-added product downstream from the covered industries in all three countries: copper, cobalt chemicals, cobalt battery cathodes, alumina, aluminum, graphite ore concentrate, spherical graphite, and graphite anodes.

Downstream facilities sited amidst such a developed industrial ecosystem also benefit from proximity to suppliers of chemicals needed for advanced processing. In contrast, the DRC struggles with high transportation costs and logistical challenges to import sulfur and sulfuric acid, which are both necessary for cobalt ore mining and processing. Alumina refineries in Guinea would have to import caustic soda and quicklime at a considerable scale to operate, while Chinese refineries can source from nearby Chinese suppliers at lower costs and with greater reliability. Mozambique is less impacted by process chemical supply chains because graphite micronization and spheroidization are mostly mechanical; however, one can assume that facilities based in Mozambique would have to import the unique machinery needed for these processes from China, given Chinese production of 99% of the world’s spherical graphite.

Bringing value-added processing to sub-Saharan Africa will require local facilities able to compete with existing facilities in places like China and the United States. Observers have devoted considerable attention to the financial and political barriers involved, often assuming that once they can be overcome, co-location with raw minerals and access to clean electricity are ample incentives to attract firms. But technical analysis emphasizes that these widely extolled factors represent just a small fraction of industry’s needs that remain under addressed in most minerals strategies—the most salient of which is the need for fossil fuels in chemical and metallurgical manufacturing.

To be sure, African countries should endeavor to substitute fossil fuels with clean alternatives wherever possible. Already, the continent is poised to develop industries using far cleaner pathways than those taken by existing industry in developed countries today. But there are immutable technological and economic limitations on the extent to which petrochemical substitutions can occur, especially amidst the intense competition of commodity markets. Both electrical and thermal energy infrastructure are vital prerequisites for countries in sub-Saharan Africa to truly take advantage of their mineral resources. And failure to pragmatically acknowledge the need for fossil fuels for modern economic growth risks jeopardizing both African development and the clean energy transition at large.